dsedy

Well-Known Angler

The guy shellengerger was fine...the two hosts on either side of him...not so much IMOThat's true, but at least he's not denying the effects of wind on the sea.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

The guy shellengerger was fine...the two hosts on either side of him...not so much IMOThat's true, but at least he's not denying the effects of wind on the sea.

Quite common. Hosts want to hear their own voices far too often and should just STFU.The guy shellengerger was fine...the two hosts on either side of him...not so much IMO

Could their overzealous greed and disregard for the environment and the ocean's wildlife actually wind up becoming our salvation? We can hope for this conclusion but also must keep the pressure on as everyone here mentions!

Some evil folks got a conscious perhaps? $'s be dammed. Not likely but maybe....They can go F themselves in any case.2nd wind developer moves to terminate its contracts off Martha's Vineyard SouthCoast Wind Cancels 1,200 MW Offshore Project Off Martha's Vineyard, Agrees to Pay $60M Termination Fee

Date: August 31, 2023

SouthCoast Wind, an offshore wind developer, announced on Tuesday its decision to abandon initial plans for a 1,200-megawatt installation in the waters off Martha’s Vineyard. The company has agreed to pay a $60 million termination fee to utility companies, signaling the official collapse of its existing contracts.

The penalty breakdown includes $32.4 million for Eversource, $27.3 million for National Grid, and $591,000 for Unitil, as per amendments filed with the Department of Public Utilities. These utility companies are set to credit the payments back to ratepayers through future contract adjustments.

This announcement comes after months of SouthCoast Wind warning that the project had become financially unfeasible due to shifting economic trends. The move echoes Commonwealth Wind, another developer that received approval last week to terminate its own offshore wind contract. Both developers intend to submit new bids in the next state solicitation, aiming for higher project valuations.

Pending approval from the Department of Public Utilities, the termination will bring down the state’s already-approved offshore wind energy capacity from 3,200 megawatts to just 800 megawatts. The Healey administration aims to secure between 400 and 3,600 megawatts in the next bidding round, in alignment with Massachusetts' clean energy law, which requires 5,600 megawatts of offshore wind power by 2027.

First reported by CommonWealth Magazine, the termination agreement awaits the green light from state regulators. If approved, this would be a significant development, raising questions about the future pricing and viability of offshore wind projects in the region.

Seems to be the ace in the hole for folks not happy about the situation, and when corporations, mostly overseas ones in the case of ocean windmills, are involved quick U-turns can occur. Have to remember that they are only looking out for the financial well being of their shareholders. Therefore the "No Bucks, No Buck Rogers" paradigm is evoked as soon as the bottom line goes red...In reality, very little of the green movement works without some form of subsidies from Government and the taxpayers.:

Seems to be the ace in the hole for folks not happy about the situation, and when corporations, mostly overseas ones in the case of ocean windmills, are involved quick U-turns can occur. Have to remember that they are only looking out for the financial well being of their shareholders. Therefore the "No Bucks, No Buck Rogers" paradigm is evoked as soon as the bottom line goes red...

Since delays and inflation were not factored in many of the construction plans, the corporate bean counters are realizing that it will be cheaper to pay the bail out penalties than to execute the contract, so "So Long Suckers!!"

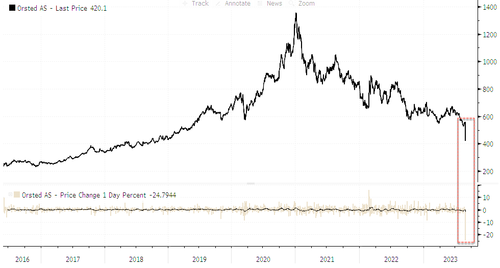

Analysts at Bernstein warned clients in a note: "Today's announcement flags risks in the US portfolio and does not do anything to improve the downbeat investor sentiment on the stock."The company's Ocean Wind 1, Sunrise Wind, and Revolution Wind projects in the US are being hurt by supplier delays, which could lead to writedowns of up to 5 billion kroner, it said late Tuesday. High interest rates could also add another 5 billion. In addition, the developer is still in talks with federal stakeholders to qualify for additional tax credits, which haven't progressed as expected. If unsuccessful, it could lead to impairments of as much as 6 billion kroner.

We ought to label Orsted's crash as the 'Green Panic.' Bulls eager to ride the climate energy revolution might want to rethink their mid-term views.BNP Paribas Exane (cut to neutral from outperform)

UBS (buy)

- The potential write-down of DKK16b dwarfs the DKK2.5b impairment announced in January, analyst Harry Wyburd writes in a note

- Investor confidence will probably be "compromised" for some time

Jefferies (buy)

- Sam Arie puts the focus on which targets will remain valid in this context

- Says today's announcement is a negative and somewhat of a surprise

- Adds investors may be concerned in the change in tone since the June CMD where management seemed more confident in regulatory changes that would help to protect the return profile of these US projects

RBC (sector perform)

- The update is a "clear negative," analyst Ahmed Farman (buy) writes in a note

- The impairments are equivalent to as much as ~7% of the Danish power generator's market capitalization

- Still, Jefferies says recent share price weakness suggests the market hasn't priced in "much value" in the company's near- term US offshore pipeline

- Alexander Wheeler also calls it a clear negative, with further doubt cast on the overall outlook for US projects, which many believed had been resolved at the capital market day

- With ~$4bn invested in the US projects to date, the impairment of up to DKK 16bn ($2.4bn) represents just over half of the overall value

- The DKK5b supplier charge is believed to be the maximum number, while on interest rates, if rates stay at current levels then the DKK 5b will be the impact booked at 9M

The Inflation Reduction Act (IRA) includes hundreds of billions of dollars in subsidies for green energy, yet now renewable developers want utility rate-payers in New York and other states to bail them out.

According to a report late last month by the New York State Energy Research and Development Authority (Nyserda), large offshore wind developers are asking for an average 48% price adjustment in their contracts to cover rising costs. The Alliance for Clean Energy NY is also requesting an average 64% price increase on 86 solar and wind projects.

The IRA includes federal tax credits that can offset 50% of a project’s costs. But renewable developers say their costs are increasing faster than inflation and that the projects will “not be economically viable and would be unable to proceed to construction and operation under their existing pricing,” says Nyserda.

Irony alert: One reason is that the government-forced green energy transition is driving up demand for equipment, material and labor. “Growing demand for renewable energy projects nationwide ‘has exacerbated inflation for renewable project cost components relative to broader inflation levels,’” Nyserda says, citing the Alliance for Clean Energy NY.

The climate lobby says power from wind and solar is cheaper than from fossil fuels, but that’s true only with generous subsidies and near-zero interest rates. Price adjustments that renewable developers want in New York would make solar and wind two- to five-times more expensive than natural gas power.

Another irony: The IRA’s prevailing wage and domestic content conditions for bonus tax credits, which are necessary to make projects viable, inflate costs. That means U.S. taxpayers will pay more for the green corporate welfare, and utility ratepayers will pay more for renewable power. The climate lobby hits you coming and going.

The speed at which these projects blew up seems stunning. But it really isn’t.Meantime, the computer chip maker Micron Technology recently disclosed that its planned factories in upstate New York, which are set to receive up to $5.5 billion in state subsidies, will consume as much power as New Hampshire and Vermont combined. Where will all the power come from?