Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gas prices 2019 and beyond

- Thread starter cany

- Start date

movetheboat

Well-Known Angler

gas up in my village...fuggers

Major Fuel Supplier On "Code Red" As Diesel Crisis Hits Southeast | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

was 3.45 this am

View attachment 55437

movetheboat

Well-Known Angler

Oil Firms Make Billions More Profits Than Expected

Drivers fear trips to the gas station. In the summer of 2022, many states had record-high fuel prices. The Biden administration stepped in to ease the pain of motorists. This reduction was temporary. Gas prices are once again on the rise. The increases mean hardship for drivers and smiles for oil giants.

Surging gas prices have caused rising profits for energy and oil companies. Breaking records. Exxon Mobil had record high profits in the third quarter raking in $19.7 billion in net income. This amount is a $2 billion increase over second-quarter earnings. (source)

The Irving, Texas, company booked $112 billion in quarterly revenue. This figure is more than double the amount brought in a year ago. In the last quarter, Chevron made record profits of $11.2 billion and revenue of $66.6 billion. (source)

Photo by Mehluli Hikwa on Unsplash

High energy costs affect consumers in several ways. Americans, especially low-income workers, have struggled in recent months to cope. Manufacturers and retailers also feel these high energy costs. But these businesses pass some of it on to consumers. Buyers spend more at the pumps, plus for consumer goods and utilities. (source)

Across America, some families are dreading the upcoming winter. The Department of Energy projects sharp price increases for home heating. Gas prices are down from their summer record of $6. But the costs remain high. The AAA says the average price of regular gas per gallon is $3.76, up from $3.40 a year ago. (source)

Demand for gas is also growing. Other companies are pulling out of the industry due to uncertainty. But Exxon will invest more in the sector. Exxon is expanding its oil refinery in Beaumont, Texas. It expects the extra refined product to become available in early 2023. (source)

dsedy

Well-Known Angler

By Housley Carr of RBN Energy

The U.S. market for distillates has been crazy the past few months — especially in PADD 1 — and given all that’s going on, it’s likely to stay that way for months to come.

Inventories of ultra-low-sulfur diesel, heating oil and other distillates are at their lowest levels for this time of year since before the EIA started tracking them 40 years ago and diesel prices are in the stratosphere, all despite diesel crack spreads being in record-high territory — a strong incentive for refineries to churn out more distillate. In today’s RBN blog, we discuss the many factors affecting distillate supply, demand, inventories and prices and take a look ahead at where the market may be headed next.

It may be true (technically speaking) that everything that comes out of a refinery is a distillate - after all, the first step in refining (after removing salt from crude oil) is boiling the oil and running it through an atmospheric distillation unit to separate crude into diesel oil, kerosene, heavy naphtha, light naphtha and other distilled products. But when we talk about distillates, we’re really talking about “middle distillates” - so-named because they condensate in the middle of the fractional distillation tank. These would include diesel and heating oil and usually jet fuel/kerosene, while vacuum gasoil (VGO) is not included.

(The terminology here can get a bit tricky as our friends outside the U.S. typically use the word “gasoil” to refer to middle distillates generally, while Americans often use the word “gasoil” to refer to VGO specifically.)

Middle distillates typically account for 25% to 50% of a refinery’s yield, depending on, among other things, the facility’s equipment and the qualities of the crude slate used. Refiners can tweak their operations and their crude slates to ramp up (or down) how much middle distillate they produce.

The events that have roiled energy markets over the past couple of years - COVID, Russia’s invasion of Ukraine, the U.S. economic recovery and (more recently) talk of a recession, to name a few - have also altered the dynamics of the U.S. distillates market, nationally but especially in PADD 1 (East Coast).

PADD 1 isn’t just a leading consumer of distillates - it’s pretty much tied with PADD 2 (Midwest) for the #1 spot - it’s also the region most dependent on others for its supply.

As in other parts of the U.S., distillates are used to fuel trucks, tractors, trains and marine vessels of every size.

They are also used in manufacturing, as a backup fuel at power plants that can be fired by either natural gas or diesel, and - importantly - for residential and commercial space heating, especially in the Northeast.

We’ve mentioned in a number of blogs that East Coast refining capacity (concentrated primarily in New Jersey, the Philadelphia area and Delaware) has been declining over the past several years. As a result, only about one-sixth of the ~1.2 MMb/d of distillates that PADD 1 consumes (annual average) is produced in-region — the rest is brought in from elsewhere. Large volumes are piped in from PADD 3 (Gulf Coast) via the Colonial and Products pipelines (the latter formerly known as the Plantation Pipeline) and much smaller volumes are piped in from the Midwest. To help meet its prodigious demand, PADD 1 also is the recipient of distillate imports, mostly from Canada, the Persian Gulf, India, Europe and Latin America.

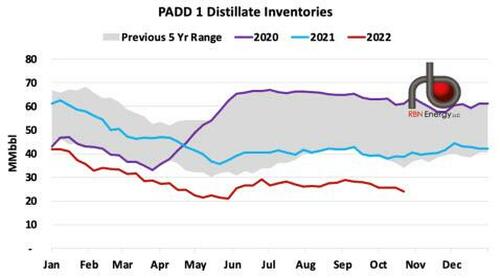

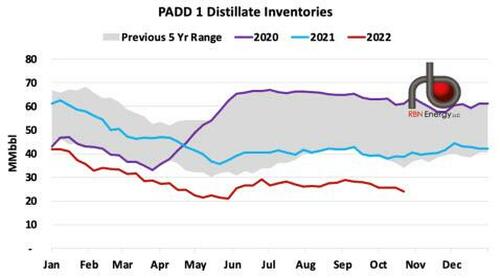

As we said in the introduction to today’s blog, the standout issue regarding the PADD 1 distillates market right now is that inventories are at a historically low level. As of the week ended October 21, they stood at a hair under 24 MMbbl (right end of red line in Figure 1), compared to more than 38 MMbbl at this time last year (blue line) and more than 60 MMbbl in mid-October 2020 (purple line).

(The average for the third week of October during the 2010-19 period was just over 50 MMb/d, or more than twice the current mark.)

Over the past three Octobers and Novembers (2019-21), implied distillate demand within PADD 1 (based on EIA’s “distillates product supplied” data) averaged 1.2 MMb/d, which suggests that East Coast inventories are only sufficient to meet about 20 days of demand — an extraordinarily thin cushion, particularly as the winter heating season begins in a region that depends heavily on heating oil.

(About 18% of households in the Northeast use heating oil as their primary space-heating fuel, down from 25% a decade ago, according to EIA.)

We’ve heard that 20 days’ supply is a low in the post-WW2 era, which if true is quite a statement.

The U.S. market for distillates has been crazy the past few months — especially in PADD 1 — and given all that’s going on, it’s likely to stay that way for months to come.

Inventories of ultra-low-sulfur diesel, heating oil and other distillates are at their lowest levels for this time of year since before the EIA started tracking them 40 years ago and diesel prices are in the stratosphere, all despite diesel crack spreads being in record-high territory — a strong incentive for refineries to churn out more distillate. In today’s RBN blog, we discuss the many factors affecting distillate supply, demand, inventories and prices and take a look ahead at where the market may be headed next.

It may be true (technically speaking) that everything that comes out of a refinery is a distillate - after all, the first step in refining (after removing salt from crude oil) is boiling the oil and running it through an atmospheric distillation unit to separate crude into diesel oil, kerosene, heavy naphtha, light naphtha and other distilled products. But when we talk about distillates, we’re really talking about “middle distillates” - so-named because they condensate in the middle of the fractional distillation tank. These would include diesel and heating oil and usually jet fuel/kerosene, while vacuum gasoil (VGO) is not included.

(The terminology here can get a bit tricky as our friends outside the U.S. typically use the word “gasoil” to refer to middle distillates generally, while Americans often use the word “gasoil” to refer to VGO specifically.)

Middle distillates typically account for 25% to 50% of a refinery’s yield, depending on, among other things, the facility’s equipment and the qualities of the crude slate used. Refiners can tweak their operations and their crude slates to ramp up (or down) how much middle distillate they produce.

The events that have roiled energy markets over the past couple of years - COVID, Russia’s invasion of Ukraine, the U.S. economic recovery and (more recently) talk of a recession, to name a few - have also altered the dynamics of the U.S. distillates market, nationally but especially in PADD 1 (East Coast).

PADD 1 isn’t just a leading consumer of distillates - it’s pretty much tied with PADD 2 (Midwest) for the #1 spot - it’s also the region most dependent on others for its supply.

As in other parts of the U.S., distillates are used to fuel trucks, tractors, trains and marine vessels of every size.

They are also used in manufacturing, as a backup fuel at power plants that can be fired by either natural gas or diesel, and - importantly - for residential and commercial space heating, especially in the Northeast.

We’ve mentioned in a number of blogs that East Coast refining capacity (concentrated primarily in New Jersey, the Philadelphia area and Delaware) has been declining over the past several years. As a result, only about one-sixth of the ~1.2 MMb/d of distillates that PADD 1 consumes (annual average) is produced in-region — the rest is brought in from elsewhere. Large volumes are piped in from PADD 3 (Gulf Coast) via the Colonial and Products pipelines (the latter formerly known as the Plantation Pipeline) and much smaller volumes are piped in from the Midwest. To help meet its prodigious demand, PADD 1 also is the recipient of distillate imports, mostly from Canada, the Persian Gulf, India, Europe and Latin America.

As we said in the introduction to today’s blog, the standout issue regarding the PADD 1 distillates market right now is that inventories are at a historically low level. As of the week ended October 21, they stood at a hair under 24 MMbbl (right end of red line in Figure 1), compared to more than 38 MMbbl at this time last year (blue line) and more than 60 MMbbl in mid-October 2020 (purple line).

(The average for the third week of October during the 2010-19 period was just over 50 MMb/d, or more than twice the current mark.)

Over the past three Octobers and Novembers (2019-21), implied distillate demand within PADD 1 (based on EIA’s “distillates product supplied” data) averaged 1.2 MMb/d, which suggests that East Coast inventories are only sufficient to meet about 20 days of demand — an extraordinarily thin cushion, particularly as the winter heating season begins in a region that depends heavily on heating oil.

(About 18% of households in the Northeast use heating oil as their primary space-heating fuel, down from 25% a decade ago, according to EIA.)

We’ve heard that 20 days’ supply is a low in the post-WW2 era, which if true is quite a statement.

Two schools of thought on that - right direction for Tuesday!

OVERBORED

Well-Known Angler

One can only hope.......The once great Empire State needs a change.Two schools of thought on that - right direction for Tuesday!

longcast

Well-Known Angler

Well said!Two schools of thought on that - right direction for Tuesday!

wader

Well-Known Angler

Today:10/11/22

Regular - $3.70

Diesel - $5.10

Regular - $3.80

Diesel - $5.80

wader

Well-Known Angler

Today:11/05/22

Regular - $3.80

Diesel - $5.80

Regular - $3.80

Diesel - $5.90

wader

Well-Known Angler

Today:11/10/22

Regular - $3.80

Diesel - $5.90

Regular - $3.76

Diesel - $5.90

movetheboat

Well-Known Angler

DEC WTI OIL UNDER 80

OPEC MEETS 12/4 they will cut production to keep the price from falling further...time to go long energy....when CHINA re-opens...ZOOOOOM!!!

WHOLESALE GASOLINE IS 2.40 SO THEY ARE "STICKING IT" TO US (OIL COMPANIES)

OPEC MEETS 12/4 they will cut production to keep the price from falling further...time to go long energy....when CHINA re-opens...ZOOOOOM!!!

WHOLESALE GASOLINE IS 2.40 SO THEY ARE "STICKING IT" TO US (OIL COMPANIES)

we went food shopping today,,, as we made the turn out the back gate,, theres a sunoco down the road,,,, i saw the gas sign,, it said $2.86 a gal ,, so after shopping i stopped in ,, there was a line at all pumps,, but what the heck,,, cheapest down here in a year,,,, but all other stations are $ 3.35a gal and up,,,,, the owner said he will keep it at this price,,,, he said he mite drop in down even more

,, so after shopping i stopped in ,, there was a line at all pumps,, but what the heck,,, cheapest down here in a year,,,, but all other stations are $ 3.35a gal and up,,,,, the owner said he will keep it at this price,,,, he said he mite drop in down even more

,,,,,,,,,,,,,,,,,,,,,,, ><)))):>

,,,,,,,,,,,,,,,,,,,,,,, ><)))):>

><))):>

,,,,,,,,,,,,,,,,,,,,,, ><)))):>

,,,,,,,,,,,,,,,,,,,,,, ><)))):>

><))):>

><))):>

oh yeah friends i forgot i paid with my sunoco card and got another 5cents off,,, so i really paid $2.81 todaywe went food shopping today,,, as we made the turn out the back gate,, theres a sunoco down the road,,,, i saw the gas sign,, it said $2.86 a gal,, so after shopping i stopped in ,, there was a line at all pumps,, but what the heck,,, cheapest down here in a year,,,, but all other stations are $ 3.35a gal and up,,,,, the owner said he will keep it at this price,,,, he said he mite drop in down even more

,,,,,,,,,,,,,,,,,,,,,,, ><)))):>

><))):>

><))):>

Thats cheap I might have to go there and fill up my truckwe went food shopping today,,, as we made the turn out the back gate,, theres a sunoco down the road,,,, i saw the gas sign,, it said $2.86 a gal,, so after shopping i stopped in ,, there was a line at all pumps,, but what the heck,,, cheapest down here in a year,,,, but all other stations are $ 3.35a gal and up,,,,, the owner said he will keep it at this price,,,, he said he mite drop in down even more

,,,,,,,,,,,,,,,,,,,,,,, ><)))):>

><))):>

?yes it is,,,, come down and stay for a bit we have room?.. general you and jen are always welcome,,,,,,,,,,,,,,,,,,, ><)))):>Thats cheap I might have to go there and fill up my truck

><)))):>

movetheboat

Well-Known Angler

diesel fuel is the KEY.....FARMERS USE IT...Truckers...Fishermen...Tankers....everyone transporting anythingDiesel fuel is so high it’s driving prices up on everything. The Mrs paid $4 today for a head of lettuce ?

Members online

Total: 3,455 (members: 14, guests: 3,441)

Latest articles

-

What happens in the Chesapeake Bay eventually shows up in New YorkNew York anglers have learned a hard truth over the decades: when Chesapeake recruitment runs...

- AI-ANGLER

- Updated:

- 3 min read

-

Two Ice Fishermen Perish in St. Lawrence CountyTragedy in Clifton: Two Ice Fishermen Perish in St. Lawrence County Snowmobile Accident Meta...

- george

- Updated:

- 4 min read

-

A Winter Angler's Paradise Just North of NYCIce Fishing Cross River Reservoir: The Ultimate Westchester Guide Meta Description Discover the...

- george

- Updated:

- 5 min read

-

Tragedy off Cape Ann: The Sinking of the Fishing Vessel Lily JeanTragedy off Cape Ann: The Sinking of the Fishing Vessel Lily Jean A comprehensive report on the...

- george

- Updated:

- 4 min read

-

The Missing Fish!The Missing Fish 198 fish went into the study. 198 fish came out alive. So where did 9% come...

- george

- Updated:

- 4 min read