Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The stock market

- Thread starter movetheboat

- Start date

wader

Well-Known Angler

USD IncludedUGLY Day

The greenback fell against all Group-of-10 peers Thursday, with havens the Japanese yen and Swiss franc leading gains. The euro rallied as much as 2.7%, the single currency’s sharpest intraday gain in close to a decade, while nearly all emerging-market currencies tracked by Bloomberg advanced. Bond markets around the world rallied amid a slide in global equities.

longcast

Well-Known Angler

Agree.I feel for people who are near to retirement and look at the Market as the road to retirement. The light at the end of the tunnel they think they've seen is the Acela from DC...

dsedy

Well-Known Angler

It was a bloodbath for sure. China 35% tarrifs on us but we don’t buy shit from them.

No supports held today Goldman said it was the biggest selling day ever.

Maybe means we are close but who knows. I just trade and the liquidity was abysmal we had 50 point 5 minute candles in the futures market.

I made it out profitable today after getting stopped out on a trade at 7:30 this morning.

Up $6.4k for the week in my trading account with very strict risk management

Expect more of the same from here on out like I said strap in

No supports held today Goldman said it was the biggest selling day ever.

Maybe means we are close but who knows. I just trade and the liquidity was abysmal we had 50 point 5 minute candles in the futures market.

I made it out profitable today after getting stopped out on a trade at 7:30 this morning.

Up $6.4k for the week in my trading account with very strict risk management

Expect more of the same from here on out like I said strap in

dsedy

Well-Known Angler

Founder's Note: Fri, April 04, 2025 at 4:15 PM ET

Macro Theme:

Key dates ahead:

- 4/4: NFP

- 4/9: FOMC Mins

4/4: Vols are getting to historically high levels, suggesting that long put holders need a reason for being - either they are hedging a portfolio or betting on downside. In either case, those puts are very expensive, and require incremental downside/bad news to justify current prices/values. Anything less than awful news and/or big declines will crush put values, and generate large, short term rallies. If weekend news is benign, then we look for a dead-cat bounce into the 5,400 area. Below, 5,000 is long term support given massive OI and that strike, and dealers holding positive gamma below that level.

In a positive outcome, we'd look for a move into 5,950, with major resistance at 6,000. This area is also where we believe vanna fuel would be totally "burned off" with VIX hitting 14'sIn a negative outcome, the immediate downside support level to watch is 5,500. We see soft support <=5,500, with room for vol to increase. For this reason we look for a move to 5,400 in a risk-off move.

Key SG levels for the SPX are:

- Resistance: 5,400

- Support: 5,000

Founder's Note:

Well, that was something.

SPX -6%, NDX -6%

VIX, +15 to 45. That is the 5th largest 1-day VIX change since Jan 20.

The VIX at 45 equates to 2.8% daily moves in the SPX. So, on one had we view that +40 VIX as quite rich, but that is against a 5% decline today and a -4.8% decline yesterday. SPX 1-month realized vol is now somewhere north of 25%, and you have to go back to late '22 to find something larger.

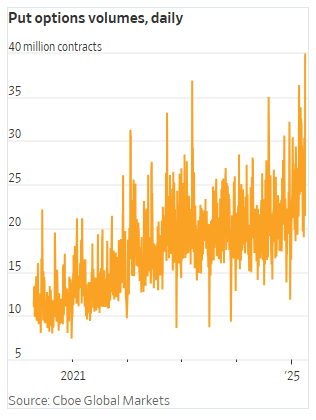

The driver of this higher vol is options demand. Preliminary indications are that this is the largest single day

put volume.

..ever. We are sure there were a lot of margin calls were going out today, particularly into end-of-day - and there was likely a lot of put activity designed to ward of margin calls.

Where do we stand, positionally speaking?

There are reasons to believe that 5,000 should be solid support. #1, there is massive OI at that strike, and while a lot of that is related to box spreads, the big-round-number has a lot of other positions there, too. Further, there are some large dealer long puts under there, which should offer positive gamma support. Not the 0DTE/short dated kind, buy longer term, more material support.

Those of you that trade options know that theta is the tax you pay to carry an option position. But when IV spikes, time decay (theta) becomes your major enemy. The image shows that theta is more negative at higher volatility, especially for at-the-money options. If you hold options, they’ll lose value faster as expiration approaches, unless the SPX moves in your favor. Put holders may have to have protection as a hedge - fine. But if you are speculatively holding long puts right now, you are hoping for Black Monday, and if you don't get that, you are going to be paying a very heavy tax. What does that mean? If the futures market isn't puking on Monday AM, it may generate a large equity rally as vols come in and put prices get crushed.

So while everyone is focused on the left move/downside "Black Monday" tail (which is legit), you cannot ignore something of a right tail rally either (little resistance until 5,400). From our viewpoint, its essentially impossible to pin the SPX given this extreme IV, so we have to "watch the tails".

One major cause for concern there is the credit market. Things seem to deteriorate in that space today, and if you look back at most historic vol spikes they are related to problems in the credit market (HYG bond ETF, below). If things break down there, then equities will be the tail that gets wagged, and VIX/vol can leap higher irrespective to put "value".

For more on these dynamics, please watch our conversation today with volatility trader Noel Smith, of Convex Asset Management.

dsedy

Well-Known Angler

its so fast 100 point 1 minute swings both ways in NQ futures the book is really thin, plus a whole lotta news then fake news its crazyAll over the place today..................................................

dsedy

Well-Known Angler

yep, then reversal once the WH denied a 90 day tarrif pause -800Correct me if I am wrong, but the fake news moved it almost 1000 points

Members online

Total: 4,056 (members: 12, guests: 4,044)

Latest articles

-

The Missing Fish!The Missing Fish 198 fish went into the study. 198 fish came out alive. So where did 9% come...

- george

- Updated:

- 4 min read

-

The Biggest Lie in Striped Bass History Started With Two FishThat’s it. That’s the number. Two. For thirty years, the entire Atlantic coast striped bass...

- george

- Updated:

- 3 min read

-

Recreational Anglers Deserve an ApologyI've Been Saying This All Along: Recreational Anglers Deserve an Apology The data is finally in...

- george

- Updated:

- 6 min read

-

Abu Garcia's Beast SeriesAbu Garcia's Beast Series: Revolutionary Equipment for the Modern Swimbait Revolution October...

- george

- Updated:

- 6 min read

-

World's Lightest Spinning ReelGame-Changer or Gimmick? The Daiwa LUVIAS ST Claims to Be the World's Lightest Spinning Reel An...

- george

- Updated:

- 4 min read