Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The stock market

- Thread starter movetheboat

- Start date

movetheboat

Well-Known Angler

Good GDP number and declining INFLATION numbers today

futures UP

futures UP

movetheboat

Well-Known Angler

Pullback and then fed rally....What a ripper this week! Risk on. See what happens next week.

Got some more shiny objects in the mail. ?

View attachment 58689

I remember buying them (gold) at 300^^...sold em

the silver is how much per in that form? I find the premium and then they want to give you below SPOT when you sell make it difficult unless a hard metal rally

dsedy

Well-Known Angler

So true.Pullback and then fed rally....

I remember buying them (gold) at 300^^...sold em

the silver is how much per in that form? I find the premium and then they want to give you below SPOT when you sell make it difficult unless a hard metal rally

Yeah I have gold from 2001 around 350 an oz. Just keep on buying I do.

Silver is insane. price is 30% over spot at 21 (thanks JP Morgan for the manipulation shorting paper SLV)

dsedy

Well-Known Angler

Zepplin: Hangman

Hangman, hangman, hold it a little while

I think I see my friends coming, riding many a mile

Friends, you get some silver?

Did you get a little gold?

What did you bring me, my dear friends

To keep me from the gallows pole?

What did you bring me to keep me from the gallows pole?

I couldn't get no silver, I couldn't get no gold

You know that we're too damn poor to keep you from the gallows pole

Hangman, hangman, hold it a little while

I think I see my friends coming, riding many a mile

Friends, you get some silver?

Did you get a little gold?

What did you bring me, my dear friends

To keep me from the gallows pole?

What did you bring me to keep me from the gallows pole?

I couldn't get no silver, I couldn't get no gold

You know that we're too damn poor to keep you from the gallows pole

movetheboat

Well-Known Angler

How much weight should we put on the fact that the S&P 500 index powered above its 200-day moving average this week? If history is any indication, then this is actually a fairly momentous occasion. Unless it's a repeat of March 2022, in which case we're obviously poised for a push to new lows any minute now.

stockcharts.com

stockcharts.com

longcast

Well-Known Angler

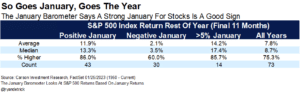

January Barometer:

No indicator is 100% correct, especially during such a wild ride with Covid lockdowns, money printing, aggressive Fed actions and supply chain dynamics going on. However, one indicator that has a very successful track record implies that as January goes, so goes the year. When we have a strong January, this indicator is even more accurate. The average return for the final 11 months following a 5% January is +14%. Even better, it has shown positive gains 86% of the time. As you can see, a negative January, like the one we had last year, has a much worse track record. We would not take this as gospel, but recognize there are a lot of reasons for this to hold true (bad news priced in last year). As of yesterday’s close, the S&P is up 5.8% year to date.

wader

Well-Known Angler

January Barometer:

No indicator is 100% correct, especially during such a wild ride with Covid lockdowns, money printing, aggressive Fed actions and supply chain dynamics going on. However, one indicator that has a very successful track record implies that as January goes, so goes the year. When we have a strong January, this indicator is even more accurate. The average return for the final 11 months following a 5% January is +14%. Even better, it has shown positive gains 86% of the time. As you can see, a negative January, like the one we had last year, has a much worse track record. We would not take this as gospel, but recognize there are a lot of reasons for this to hold true (bad news priced in last year). As of yesterday’s close, the S&P is up 5.8% year to date.

one can hope

Snapprhead27

Well-Known Angler

Do you find one company charges more over market then others? I've always wanted to do this, but wasn't sure where to begin.What a ripper this week! Risk on. See what happens next week.

Got some more shiny objects in the mail. ?

View attachment 58689

BennyV

Well-Known Angler

Ampex is pretty competitive. Try this out below. It’s a good tool to find the best deal.Do you find one company charges more over market then others? I've always wanted to do this, but wasn't sure where to begin.

Compare Best Prices on Silver and Gold | Silver Spot Price deals

Find the cheapest prices from major dealers before you buy silver bars and rounds, gold coins, bars. Find the best prices on gold and silver. Silver at Spot Price Deals.

movetheboat

Well-Known Angler

Here’s the facts silver and gold have increased 400% over 20 years …… unfortunately so has , food,gas, housing,utilities etc … so I guess it’s an ”ok” hedge against inflation and certainly better than money sitting in the bank…… here is another interesting fact , copper has increased 700% and Lead over 1800% in 20 years , so I guess it’s better to hoard pennies and fish sinkers

dsedy

Well-Known Angler

and 100% Tax Free! A person can walk into any gold/jewerly buyer and covert the asset into any FIAT immediately. No trace n0 track, no disclosure 100% tax free. It can be passed along to heirs privately with no estate tax. Gold is the only money. FIAT is debt ripe for confiscation and corruption.Here’s the facts silver and gold have increased 400% over 20 years …… unfortunately so has , food,gas, housing,utilities etc … so I guess it’s an ”ok” hedge against inflation and certainly better than money sitting in the bank…… here is another interesting fact , copper has increased 700% and Lead over 1800% in 20 years , so I guess it’s better to hoard pennies and fish sinkers

movetheboat

Well-Known Angler

THAT'S TRUE i NEVER paid any gain on metals....silver because of its huge industrial use looks better to me. Hell...remember when it soard to 50 bucks in the 80s when the Hunt bros? cornered the market. A lot of people got burned leading to a 20 or so year bear market in metalsand 100% Tax Free! A person can walk into any gold/jewerly buyer and covert the asset into any FIAT immediately. No trace n0 track, no disclosure 100% tax free. It can be passed along to heirs privately with no estate tax. Gold is the only money. FIAT is debt ripe for confiscation and corruption.

but it's so damn pretty to look at lol

BennyV

Well-Known Angler

I kind of like Warren Buffetts take on gold, but like any wealth storing asset if it makes you sleep well at night go for it.

Cash, cash like equivalents - HYSA/treasuries/etc, precious metals, diamonds, bonds, bitcoin, etc…

Hold as much as it takes for you to keep your head on that pillow.

Cash, cash like equivalents - HYSA/treasuries/etc, precious metals, diamonds, bonds, bitcoin, etc…

Hold as much as it takes for you to keep your head on that pillow.

movetheboat

Well-Known Angler

FED DAY!!!! Strap in boys and girls

25% rate increase and a watch and see attitude would be nice!!

25% rate increase and a watch and see attitude would be nice!!

movetheboat

Well-Known Angler

yupPullback and then fed rally....

movetheboat

Well-Known Angler

GOOD LUCKearnings report tomorrow for Estee.....................

?

movetheboat

Well-Known Angler

sold some stuff after hours...pullback likely...good day!!! WHATTA country!!

Latest articles

-

A Winter Angler's Paradise Just North of NYCIce Fishing Cross River Reservoir: The Ultimate Westchester Guide Meta Description Discover the...

- george

- Updated:

- 5 min read

-

Tragedy off Cape Ann: The Sinking of the Fishing Vessel Lily JeanTragedy off Cape Ann: The Sinking of the Fishing Vessel Lily Jean A comprehensive report on the...

- george

- Updated:

- 4 min read

-

The Missing Fish!The Missing Fish 198 fish went into the study. 198 fish came out alive. So where did 9% come...

- george

- Updated:

- 4 min read

-

The Biggest Lie in Striped Bass History Started With Two FishThat’s it. That’s the number. Two. For thirty years, the entire Atlantic coast striped bass...

- george

- Updated:

- 3 min read

-

Recreational Anglers Deserve an ApologyI've Been Saying This All Along: Recreational Anglers Deserve an Apology The data is finally in...

- george

- Updated:

- 6 min read