movetheboat

Well-Known Angler

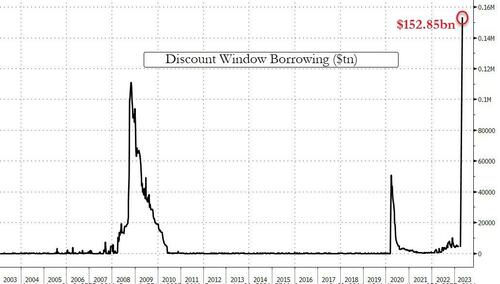

dow futures down 500....European banks now

Last edited:

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/Z7VCVZB77JK3HGNX7575QGNG6M.jpg)

Hi Don...lol!It’s on like Donkey Kong! Higher she goes…. Until the next blow up ?

It’s on like Donkey Kong! Higher she goes…. Until the next blow up ?

Looking for the end of that damn rainbow!Got Gold?

View attachment 60570

Here’s a trend for you to watch. WOKE banks not being FDIC approved. View attachment 60595

The end of the rainbow is actually a lot of pain.Looking for the end of that damn rainbow!

Investment Accounts at WF Securities are covered by SIPC up to 250K, just like any bokerage account. What you are posting is from the regular bank for checking and savings accounts which is only covered by FDIC. Those are two separate entities. The bank offers checking and savings, the Securities division offers investment and insurance solutions. Completely segregated.Here’s a trend for you to watch. WOKE banks not being FDIC approved. View attachment 60595