The result of politicians in Washington racking up a $33.7 trillion federal debt? It now takes over a fifth of all government revenues just to pay the interest.

www.foxbusiness.com

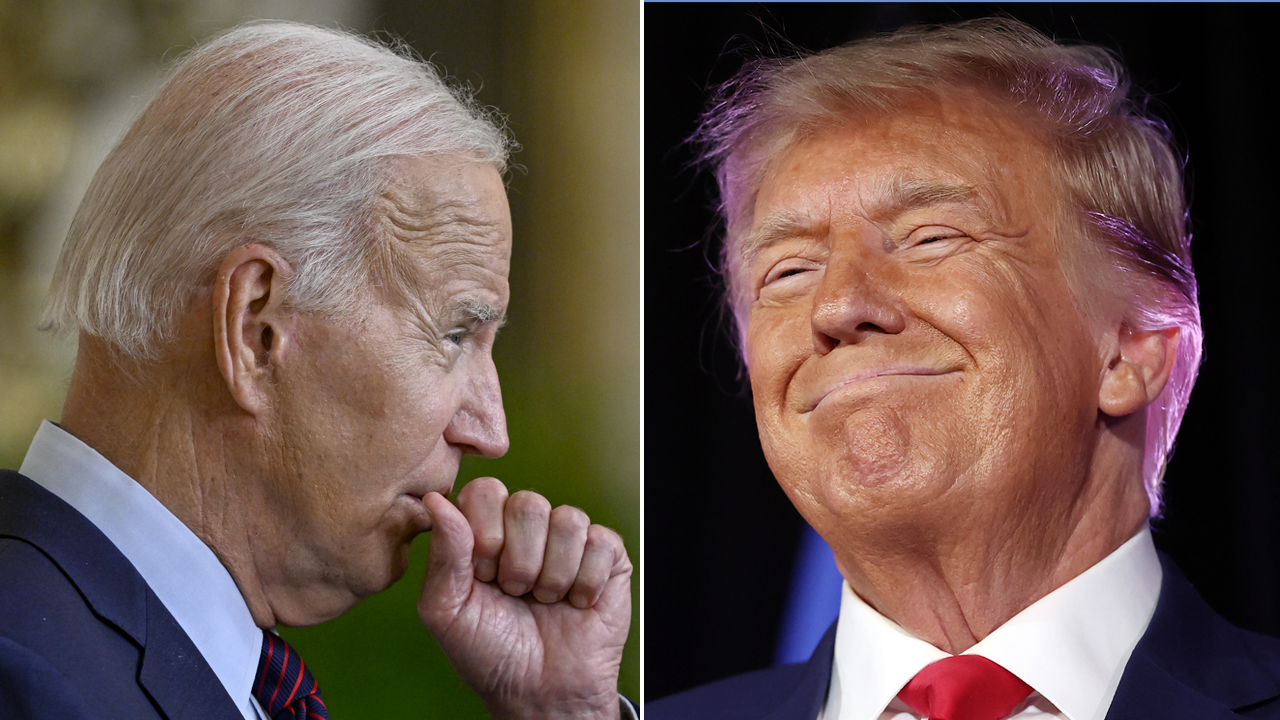

Only took 2.75 years for these amazing results!

The recent monthly Treasury statement from the Fiscal Service showed that the Treasury Department paid $88.9 billion in October on

interest for the federal debt. That’s almost double what it paid in October of the previous year. Worse, the Treasury is projecting interest payments for the fiscal year to exceed $1 trillion. Every month that goes by, the Treasury increases that forecast as the outlook worsens.

As deficit spending continues unchecked, urged on by the Biden administration, the debt is growing at a breakneck pace – over $500 billion in October alone. That, along with higher interest rates, has increased the cost to service the debt at the fastest rate on record. This additional expense further increases the deficit, which of course further increases the total debt. The nation is trapped in a vicious cycle.

The catch is that debt issued today must pay today’s interest rates, so the Treasury is rolling over debt at 5% that was previously issued at 1% to 2%.

This sorry situation is a direct result of the Biden administration’s runaway spending and big-government agenda. Had President Biden literally done nothing when he got into office and simply allowed all the one-time emergency spending from COVID to expire, government expenditures would’ve fallen so steeply that we’d have a balanced budget today, with interest on the debt just half its current level.

Instead, the Biden administration and its big-spender allies in Congress have institutionalized multitrillion-dollar deficits, embedding the problem firmly into the fabric of federal finance.